Knowing what expenses are not tax deductible might help company to minimise such expenses. Non-business expenses for example domestic or household expenses and taxes are not deductible.

Comparison Of Zakat And Taxation

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021.

. Knowing which expenses qualify under deductible tax expenses also helps you to apply successful cost optimisation. In general start-up expenses incurred before the commencement of a trade profession or business are capital in nature as they were expended to put the person in a position to earn income. In general expenses incurred for the production of business income are tax deductible.

Private automobile expenses are not deductible. Its under the so-called Staff Benefit and Amenity so its deductible for tax purposes for company accounting. Mortgage interest incurred to finance the purchase of a house is deductible only if income is derived from.

Contributions made to WWF-Malaysias Gaharu Project are tax deductible. WWF-Malaysia will issue the tax-deductible receipts for donations on a quarterly basis. Corporate Tax Planning in Malaysia.

To be endorsed as income tax exempt your charity must meet certain requirements. The EPF not only functions as a retirement fund it is also a multi-purpose savings fund that allows withdrawals to be made to finance housing education and medical expenses. Expenses that were not incurred in the production of profits.

Single deduction for pre-commencement expenses-Withholding tax exemption on any payments made to non-residents wef 10102011 to 31122021. For example your tenant pays the water and sewage bill for your rental property and deducts it from the normal rent payment. The SCIT is similar to the 5 gross income tax GIT under the previous incentive regime which is computed based on the registered enterprises gross income.

This deduction is an add-on to the disabled child relief if they are. However according to the Inland Revenue Department of Hong Kong the following expenses are not tax deductible. Where the company is exempt or taxed at a reduced rate the excess.

The current general capital gains tax rate is 10. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Donations to approved institutions or organisations are deductible subject to limits.

And while advisors and clients have had a few years. Effectively a deficiency withholding tax assessment will also result in a deficiency income tax exposure since the related deductible expense will also be disallowed. Expenses paid by tenant occur if your tenant pays any of your expenses.

An operating lease is a contract that allows for the use of an asset but does not convey rights of ownership of the asset. The customary costs and expenses of a business are generally acceptable as deductible expenditure for CIT purposes provided they are necessary reasonable and have been realised during the relevant tax year under the accrual or cash method of accounting as the case may be. You must include them in your rental income.

An additional exemption of RM8000 is applicable for an unmarried disabled child receiving a full-time education in Malaysia or overseas. A business owner is also encouraged to have a general taxation knowledge especially regarding various types of taxes deadlines payments and penalties involved such as the penalty imposed on an underestimation of tax payable by. Assuming per trip is RM10000 and three times per year is RM30000 this RM30000 will be exempted and does not have to go in to your EA form.

The Tax Cuts and Jobs Act of 2017 commonly referred to as TCJA eliminated the deductibility of financial advisor fees from 2018 through 2025. These appear as costs in your business accounts deducted from the profit you pay tax on. Whether or not your insurance premiums are tax deductible depends on your own or your companys specific tax situation.

The cap increases to 2 if the company implements any. Meets at least one of three tests. The following are more common non-allowable expenses.

Deductible up to 70 of SI. This principle is based on Section 34K of the Tax Code which states that an expense will be allowed as a deduction for income tax purposes only if it is shown that the tax. Since January 2007 contributions to the fund are split between two accounts which were created for different types of withdrawals.

Deductible gift recipient test. Learn about the deductibility of specific business expenses M-R. If taxpayer is unable to provide sufficient documentation to support the expenses claimed as tax deductible the IRB is.

The expenses that are not income tax deductible are initial expenses before the property is rented out including. Certain expenses have often been refused a tax deduction even though for businessman they are regarded as necessary business costs. Entertainment expenses are tax-deductible up to the lesser of 60 of the costs actually incurred and 05 of the sales or business income of that year.

Tax planning is the process of looking at the available tax options in order to determine how the Company can conduct the business transactions so that taxes are eliminated or reduced. Otherwise the amount deductible will be limited to 1 of total payroll. 30 of value added exports.

A tax relief of up to RM2500 is deductible for purchases of lifestyle equipment for. The tax deduction for medical expenses is limited to 2 of total payroll if the employer implements certain portable medical insurance or benefit schemes. Perhaps what could be relevant to the export enterprises is how the tax regulators will treat the deductible expenses in computing the 5 SCIT under the implementing guidelines.

You can deduct the expenses if they are deductible rental expenses. Premiums refer to the monthly or annual fees you pay to have insurance Thanks to Canadas Income Tax Act ITA deductibility of insurance premiums is a complicated maze of specific rules for specific scenarios. All personal costs andor any other costs andor related expenses that are incurred to purchase the MHupgrade are at Passengers sole responsibility and own costs.

Expenses can reduce the average sole traders tax billoften significantly. Your charity is entitled to be endorsed for income tax exemption if it. However there are specific deductions allowed such as incorporation expenses and recruitment expenses conditions apply.

For example if your turnover is 80000 and you claim 20000 in allowable expenses you only pay tax on the remaining 60000a substantial saving. An operating lease represents an off-balance sheet. Expenses that are not incurred.

Medical expenses for parents. Staff welfare expenses labour union fees and staff education expenses are tax-deductible at up to 14 2 and 8 of the total salary expenses respectively. Prescribed by law test meets both of the following conditions Governing rules condition.

View Example 1 PDF 56KB for an illustration of how the medical expense capping is applied. Stay in Malaysia less than 182 days are taxed at flat rate of 28 without any personal reliefsdeductions and rebates. Malaysia offers a wide range of tax incentives ranging from tax exemptions allowances to enhanced tax deductions.

Medical expenses incurred for employees are tax-deductible as long as they are capped at 1 of the total employee remuneration accrued for the year. So from the companys point of view its deductible.

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

Income Tax Malaysia General And Specific Deductions Pdf Expense Tax Deduction

List Of Income Tax Relief For Lhdn E Filing 2022 Ya 2021 Iproperty Com My

Income Tax Tips For Malaysian Artists Penang Art District

Govt Extends Tax Relief For Phones Computers Includes Covid 19 Tests For Medical Tax Relief

Digital Nomads Expat Tax Professionals

Comparison Of Zakat And Taxation

Income Tax Tips For Malaysian Artists Penang Art District

Tax Benefits For Human Capital Development Crowe Malaysia Plt

Income Tax Malaysia General And Specific Deductions Pdf Expense Tax Deduction

Malaysia Income Tax Deduction For Businesses 3rd Edition Accounting Books New Releases Jun Nov 2021 Hong Kong International Edm

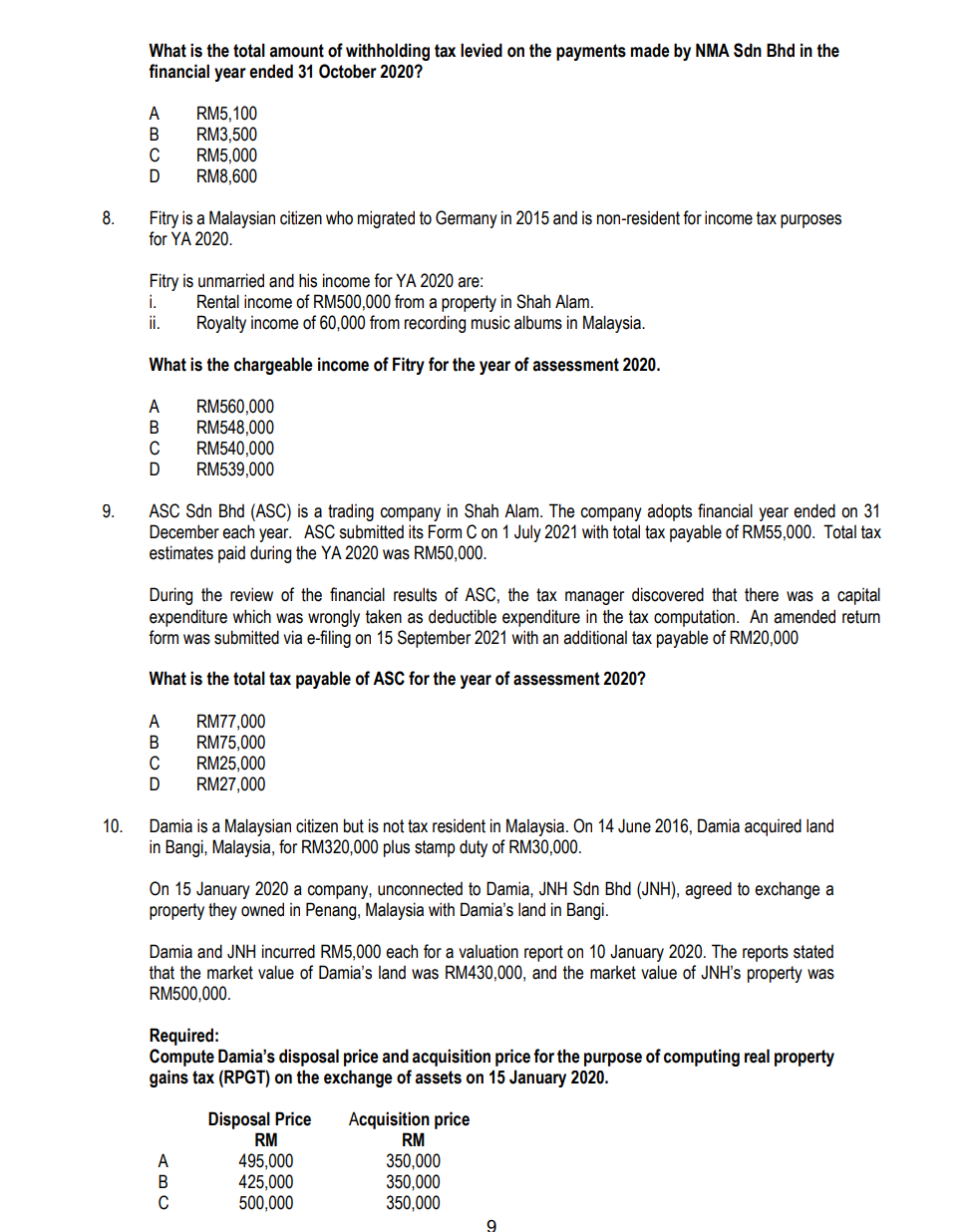

Section B All Six Questions Are Compulsory And Must Chegg Com

Deduction On Renovation And Refurbishment Costs Of Business Premises Ey Malaysia

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

Income Tax Tips For Malaysian Artists Penang Art District

Economic Stimulus Package 2020 L Co

Withholding Tax In China China Briefing News

Tax Deductible Expenses Malaysia Julianagwf